ohio unemployment income tax refund

The State of Ohio. Once the missing Quarterly Tax Return is processed you will be assessed penalty and interest.

1099 Self Employed Part Time Workers Can File For Unemployment Wtol Com

If you do not wish to.

. Changes in how Unemployment Benefits are taxed for Tax Year 2020. Taxpayers who made under 37000 annually were also exempt from paying income tax on. To amend an original report online please visit.

They are included in the gross income number taken. In all about 13 million taxpayers may be eligible for a federal tax deduction on last years jobless benefits according to the IRS. To obtain the refund status of your 2021 tax return you must enter your social security number your date of birth the type of tax and whether it is an amended return.

Mike DeWine signed a state law on. The tax only applied to interest and dividend income and only if it exceeded 1250. Used by employers to amend an original quarterly tax return.

Taxation of unemployment benefits in Ohio. On April 6 2021 the Department of Taxation issued the tax alert Ohio Income Tax Update. The Ohio Department of Taxation provides a tool that allows you to check the status of your income tax refund online.

You can check the status of your current year refund online or by calling the automated line at 260-7701 or 1-800-218-8160. The Earned Income Tax Credit EITC is a refundable tax credit for low-to-moderate income workers who have worked and earned income under the amount of 57414 in 2021. To obtain the refund status of your 2021 tax return you must enter your social security number your date of birth the type of tax and whether it is an amended return.

I thought that unemployment benefits were not taxable by the state of Ohio. You may apply for a waiver of these assessments. Income Tax Refund Information.

If you received unemployment benefits in 2020 a tax refund may be on its way to you. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189. JFS-20129 Request to Amend the Quarterly Tax Return.

You can also call the departments individual taxpayer. Should you have any questions please call.

Amend Your Irs State Tax Return Unemployment Change

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

2021 Ohio State Income Taxes Done On Efile Com In 2022

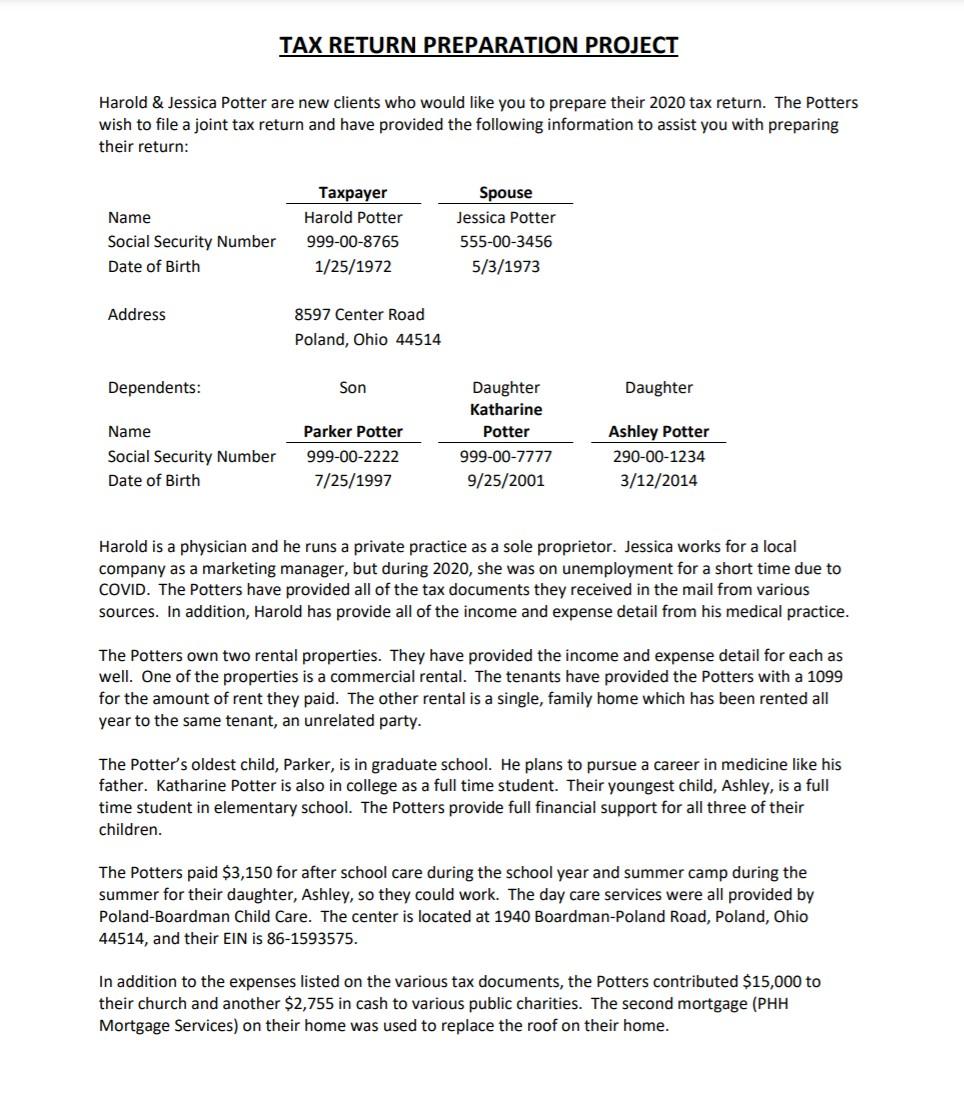

I Need To Prepare The 2020 Federal Income Tax For The Chegg Com

Income Tax Preparation Services Akron Ohio 1040 1065 1120

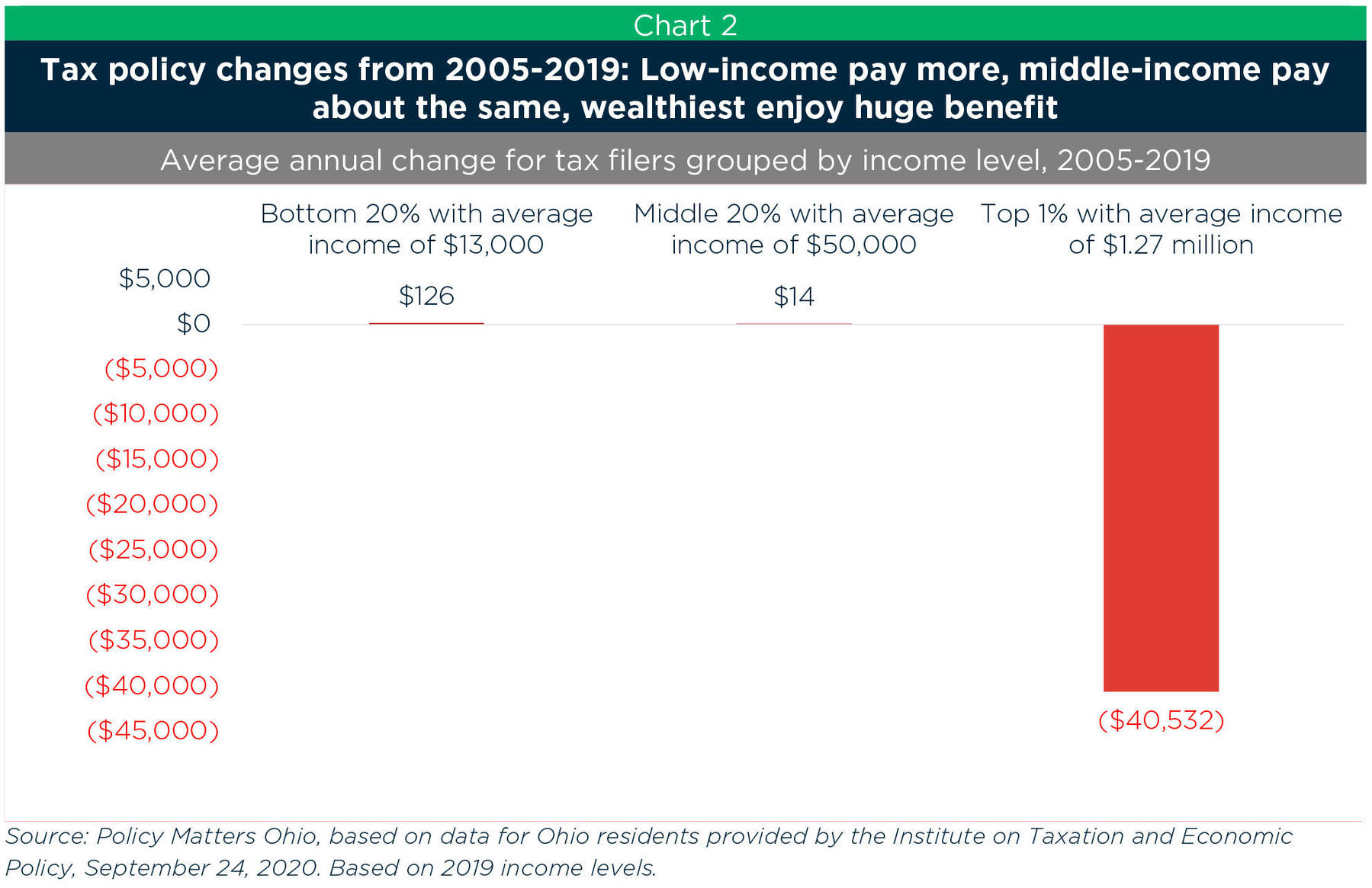

Rebalance The Income Tax To Build A Better Ohio For Everyone

Ohio It 941 Fill Out Sign Online Dochub

When Will Unemployment Tax Refunds Be Issued 10tv Com

Income General Information Department Of Taxation

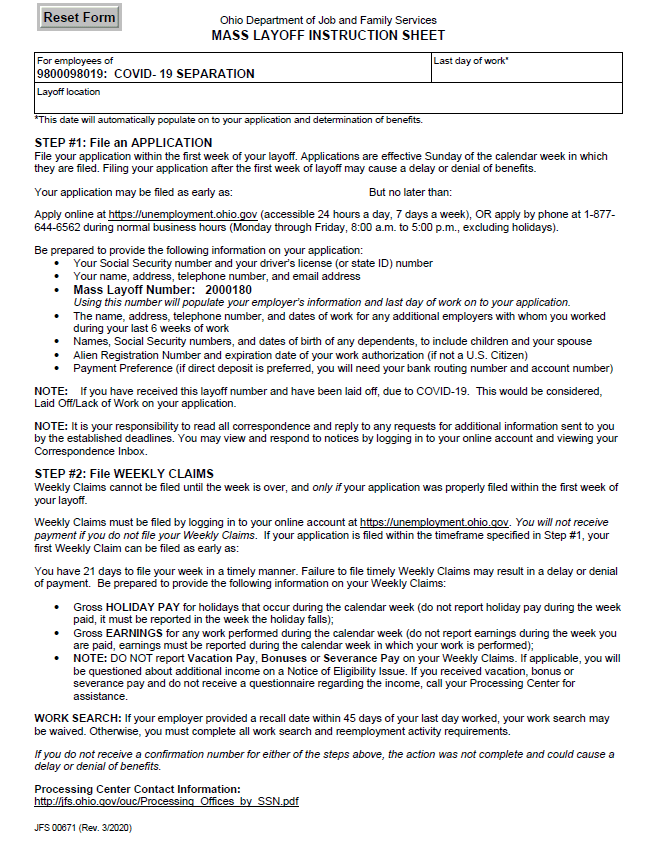

Covid 19 Unemployment Benefits Hamilton Ryker

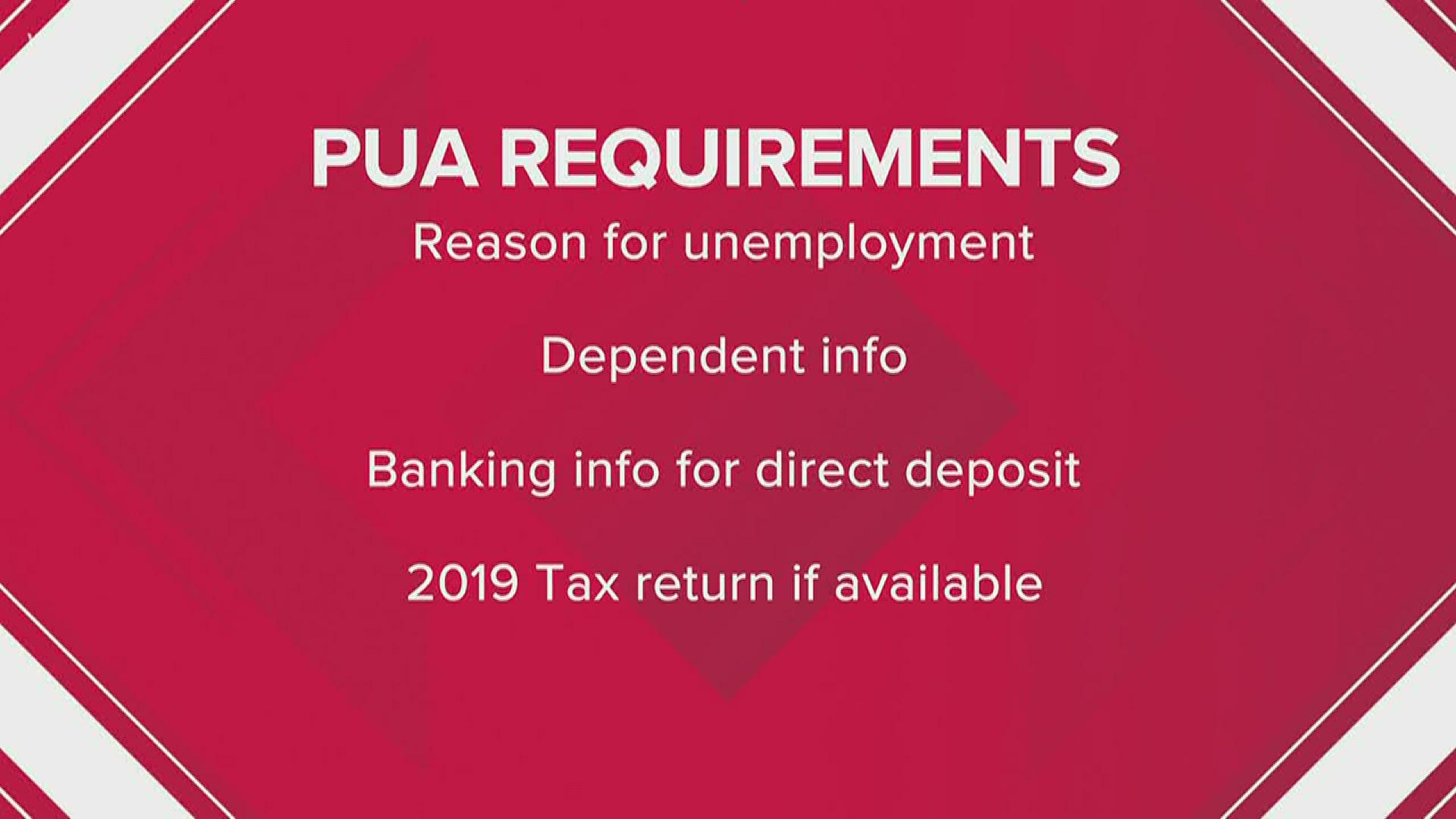

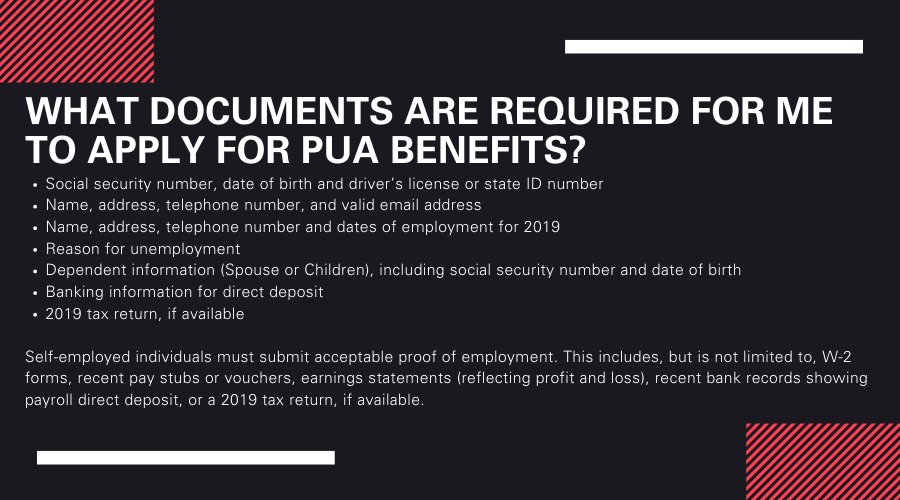

Ohiojfs On Twitter What Documents Are Required For Me To Apply For Pua Benefits For Answers To More Faq S Visit Https T Co Eummtiixu4 Inthistogetherohio Everyclaimisimportant Covid19 Https T Co Ab2yoopyfn Twitter

Covid 19 Unemployment Benefits Hamilton Ryker

H R Block Good News Up To 10 200 Of Your Unemployment Income Could Be Tax Free The Irs Will Automatically Adjust Your Taxes And Any Refunds Will Start Going Out In May

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

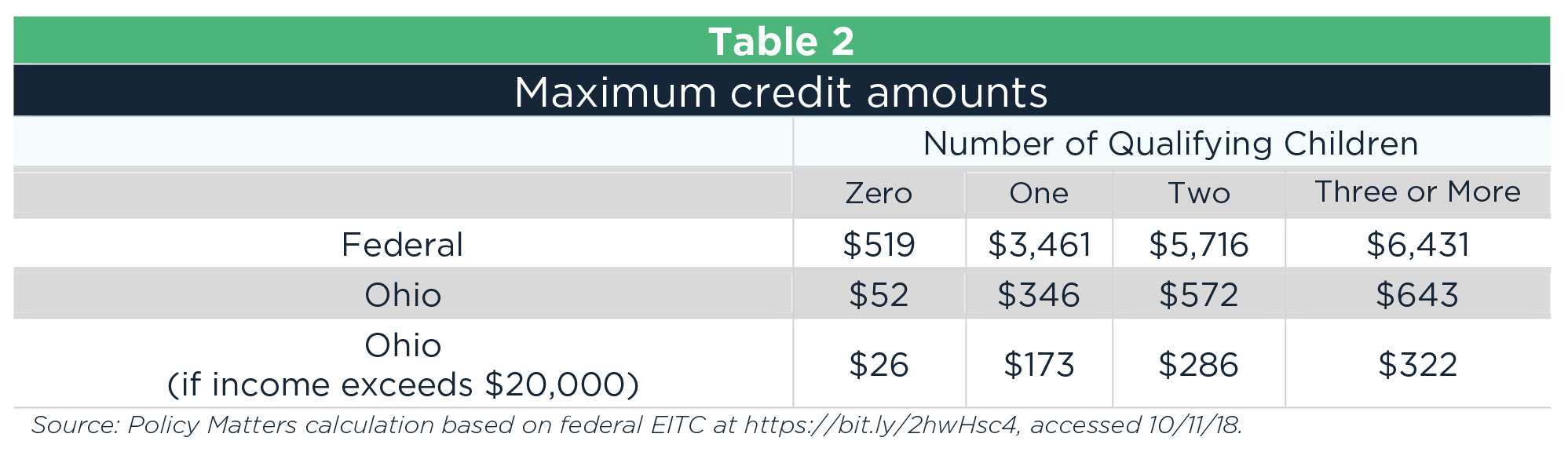

Refundable Tax Credits For Working Families Put Kids First

An Agricultural Employer S 2021 Tax Obligations A Series Part Ii Farm Office

Officials Warn Residents To Keep Eye Out For Erroneous 1099 G Forms Wtov