per capita tax definition

Can you provide me with my invoice number so that I can make a payment online. Per capita is a measurement that helps compare different nations statistics on a per person basis.

Information About Per Capita Taxes York Adams Tax Bureau

Do I pay this tax if I rent.

. Per Capita Tax is a tax levied by a taxing authority to everyone over 17 years of age residing in their jurisdiction. It is not dependent upon employment. Can I confirm the balance due for my tax bill.

By or for each individual a high per capita tax burden. The school district as well as the township or borough in which you reside may levy a per capita tax. Per capita GDP is a global measure for.

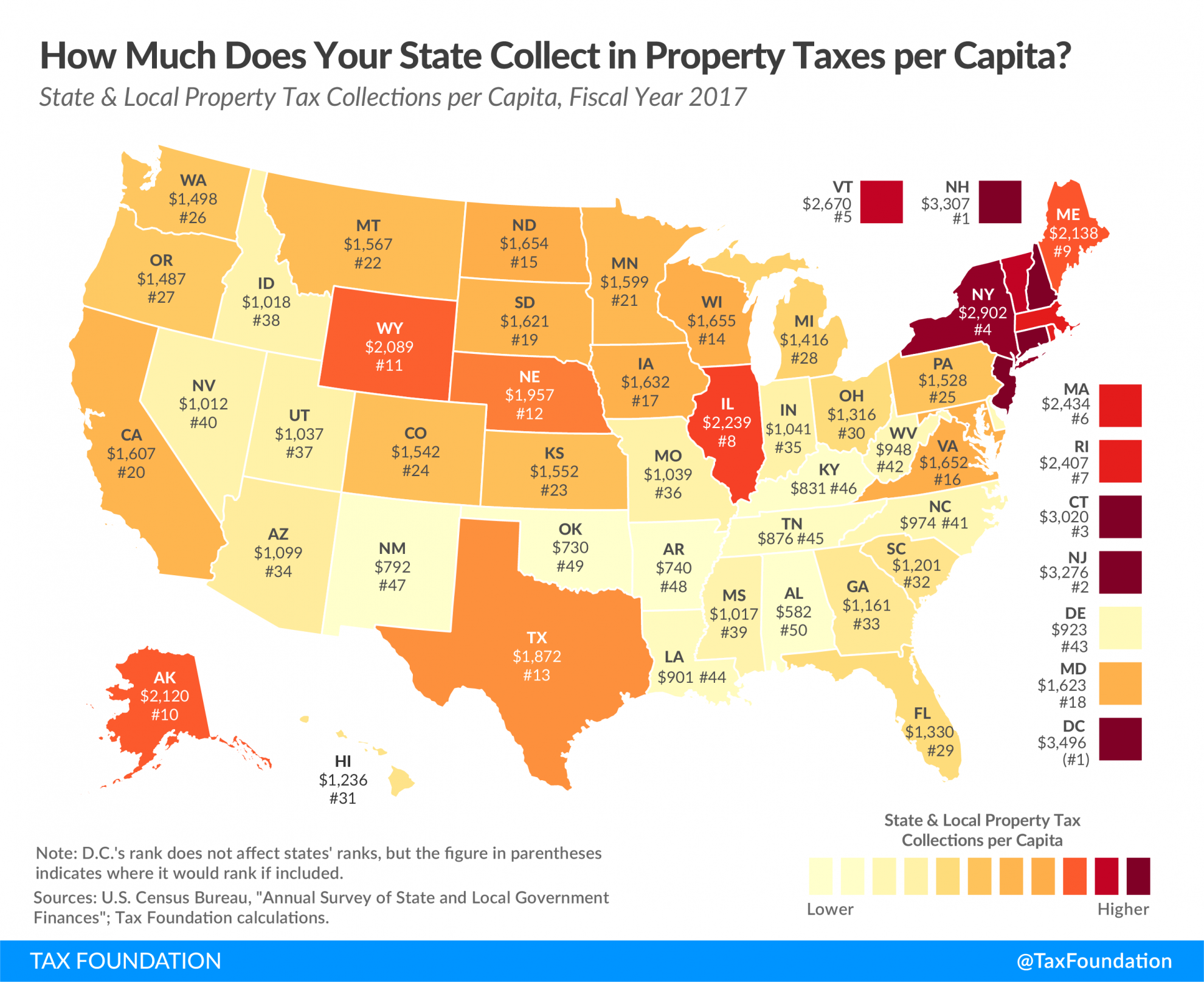

Per capita is Latin for by head All the living members of the identified group will receive an equal share if the beneficiaries are to share in a distribution per capita. On average state and local governments collected 1675 per capita in property taxes nationwide in FY 2018 but collections vary widely from state to state. Well income per capita is basically the amount of money per person in a specific area.

Can I request a correction. The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. A share wont be created for the deceased beneficiary and all the other beneficiaries shares will be increased accordingly if one of the identified group is deceased.

Per capita is the legal term for one of the ways that assets being transferred by your will can be distributed to the beneficiaries of your estate. Per capita Unit Number of people in a population. More specifically according to the United States Census Bureau it is the money earned by every man woman.

I moved and no longer live in this area. Both taxes are due each year and are not duplications. It means to share and share alike according to the number of individuals.

Tennessees tax on investment incomeknown as the Hall taxis being phased out and will be fully repealed by tax year 2021. For most areas adult is defined as 18 years of age or older. The term is used in a wide variety of social sciences and statistical research contexts including government statistics economic indicators and built environment studies.

Means that as- pect of a plan which pertains to the in- dividualization of the judgment funds in the form of shares to tribal members or to individual descendants. The highest state and local property tax collections per capita are found in the District of Columbia 3740 followed by New Jersey 3378 New Hampshire 3362 Connecticut 3107 New York 3025 and. What is the Per Capita Tax.

Under a per capita distribution each person named as beneficiary receives an equal share. Seven states do not levy an individual income tax. I did not receive my per capita tax bill.

By using per capita economists are able to more accurately compare the size of two nations economies. Normally the Per Capita tax is NOT. Per capita income PCI or total income measures the average income earned per person in a given area city region country etc in a specified year.

In these days of diminishing resources and tight budgets the Presbyterian Church USA continues to seek new and innovative ways to provide ministry and support to mid councils presbyteries and synods across the country. My billaccount information is incorrect eg addresslast name. It is commonly used in the field of statistics in place of saying per person although per caput.

On average state and local governments collected 1164 per capita in individual income. Define Per Capita Payment. The following formula can be used to determine the per capita.

Calculating per capita entails taking into account a measurement or number amount by which you will then divide by the total population of the group wishing to be analyzed. In a per capita distribution an equal share of an estate is given to each heir all of whom stand in equal degree of relationship from a decedent. Presbyterians have used per capitaan annual per member apportionment assessed by the General Assembly Book of Order G.

Used primarily in economics PCI utilizes average income to calculate and present the standard of living. Per Capita Latin By the heads or polls A term used in the Descent and Distribution of the estate of one who dies without a will. In other words if you.

Per capita income is often used to measure a sectors average income and compare the. It is calculated by dividing the areas total income by its total population. Per Capita means by head so this tax is commonly called a head tax.

Can I have a copy sent to me. Is this tax withheld by my employer. This tax is due yearly and is based solely on residency it is NOT dependent upon employment or property ownership.

For most areas adult is defined as 18 years of age and older though in some areas the minimum age may differ. Per capita income is national income divided by population size. Standard of Living The standard of living is a term used to describe the level of income necessities luxury and other.

Whether you rent or own if you reside within a taxing district you are liable to pay this tax to the district. Per capita income PCI or average income is the measurement of average income per person in a specific country city or region within a definitive time period. Alaska Florida Nevada South Dakota Texas Washington and Wyoming.

Per capita is a Latin phrase literally meaning by heads or for each head and idiomatically used to mean per person. This tax is due yearly and is based solely on residency it is NOT dependent upon employment or property ownership. The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction.

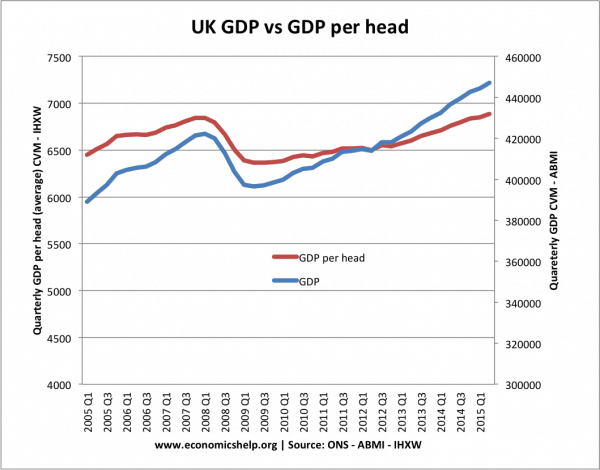

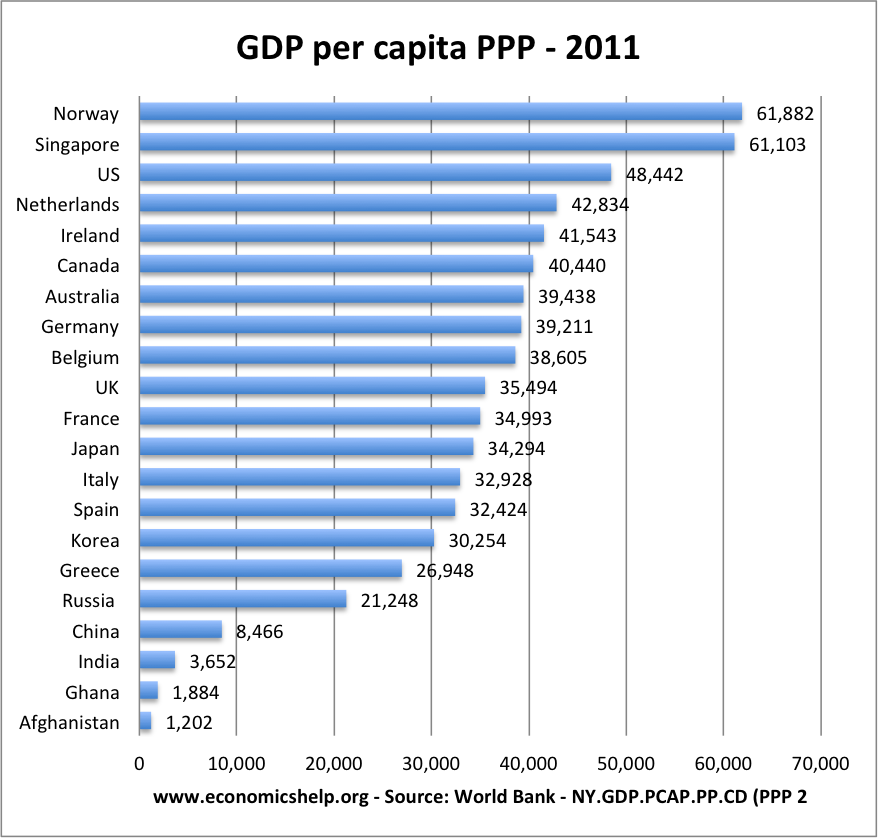

A Per Capita tax is a flat rate tax equally levied on all adult residents within a taxing district. Per capita gross domestic product GDP measures a countrys economic output per person and is calculated by dividing the GDP of a country by its population. Per unit of population.

I lost my bill. Per capita helps economists compare GDP figures by accounting for large differences in population.

Real Gdp Per Capita Economics Help

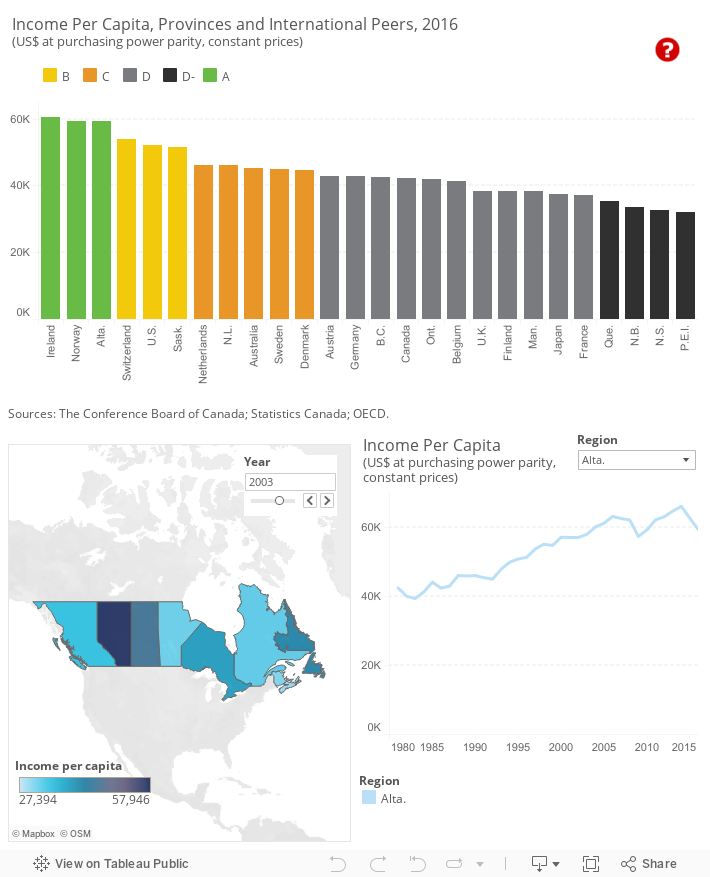

Income Per Capita Economy Provincial Rankings How Canada Performs

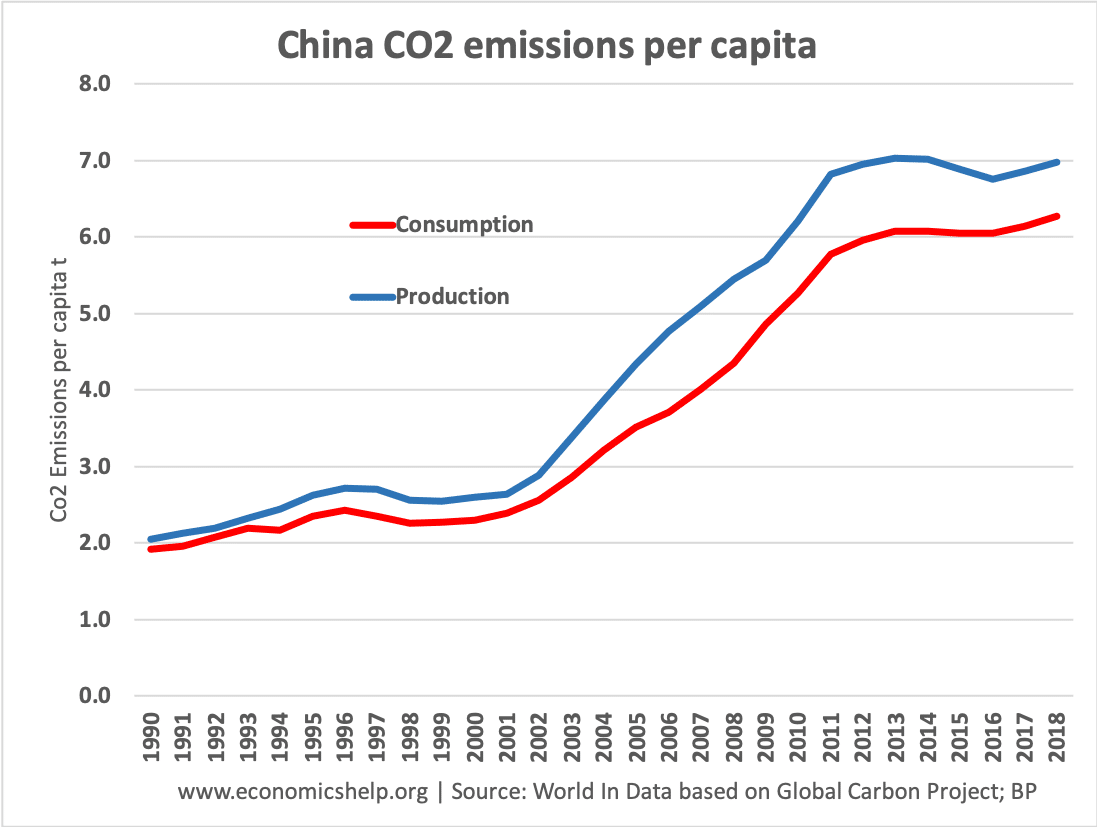

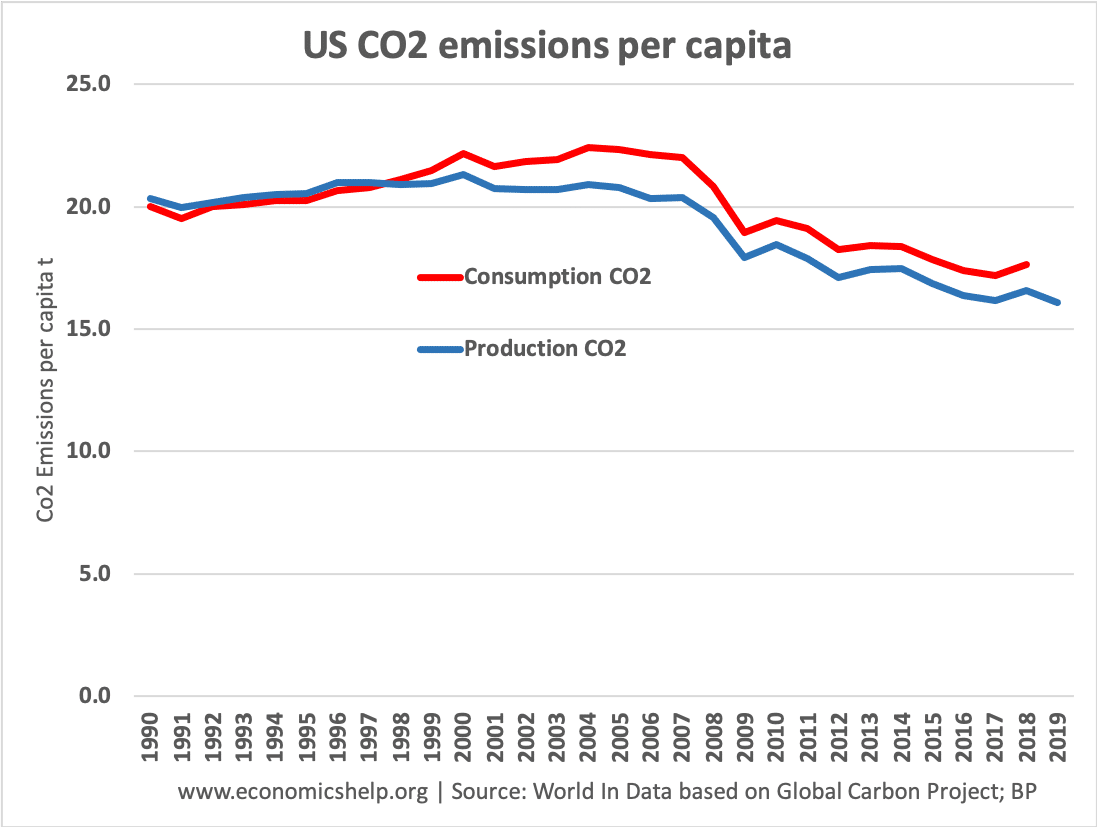

Top Co2 Polluters And Highest Per Capita Economics Help

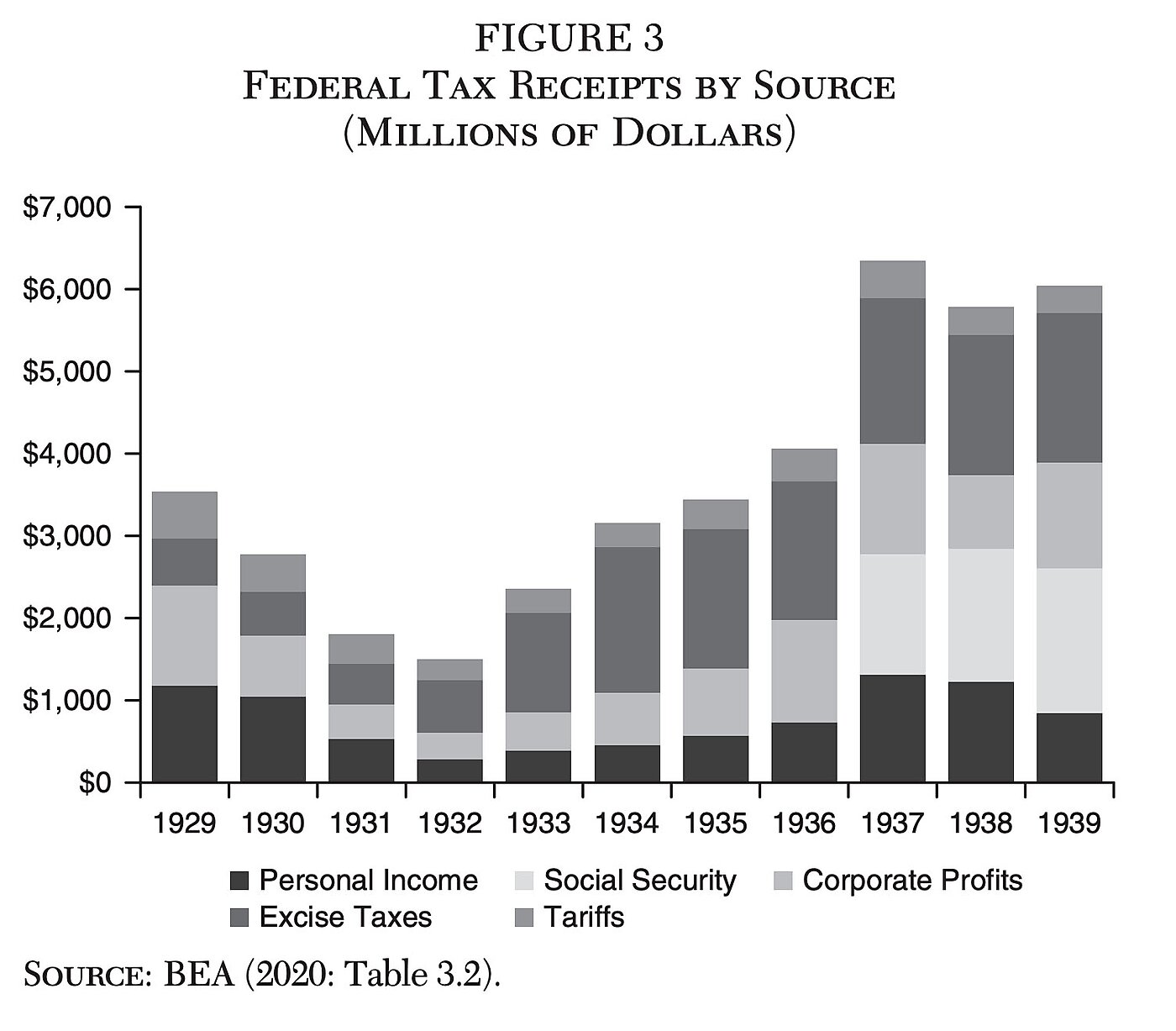

The Economic Impact Of Tax Changes 1920 1939 Cato Institute

Property Tax Definition Property Taxes Explained Taxedu

Real Gdp Per Capita Economics Help

India National Income Per Capita 2022 Statista

Peru Gdp Per Capita Constant Dollars Data Chart Theglobaleconomy Com

Per Capita Definition Formula Examples And Limitations Boycewire

Hong Kong Gdp Per Capita Constant Dollars Data Chart Theglobaleconomy Com

How Is Tax Liability Calculated Common Tax Questions Answered

Key Aspects Of Per Capita Personal Income

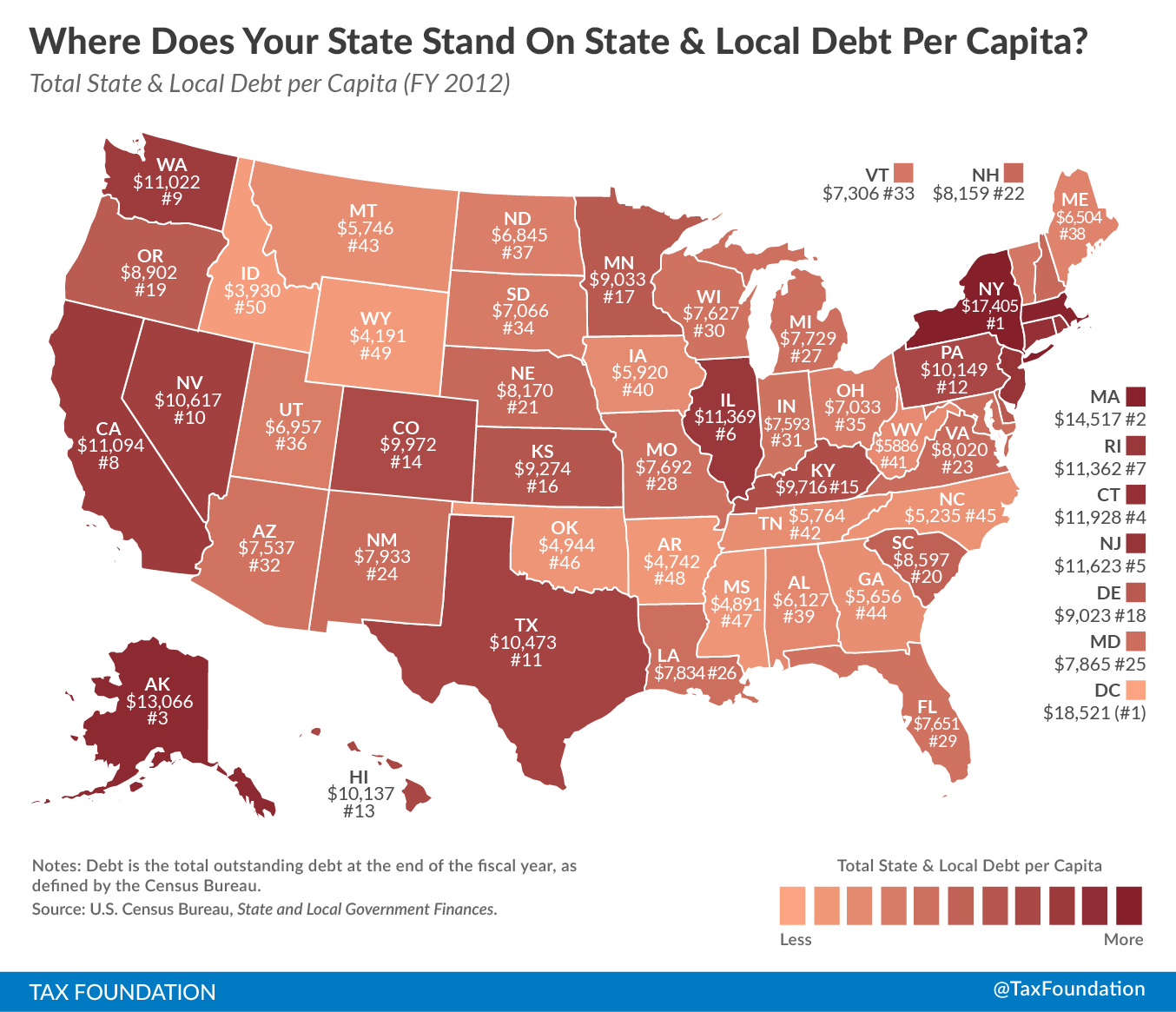

Where Does Your State Stand On State Local Debt Per Capita Tax Foundation

Property Tax Definition Property Taxes Explained Taxedu

/GettyImages-545863985-e964b845dce944dfb2b94153aab83a7a.jpg)